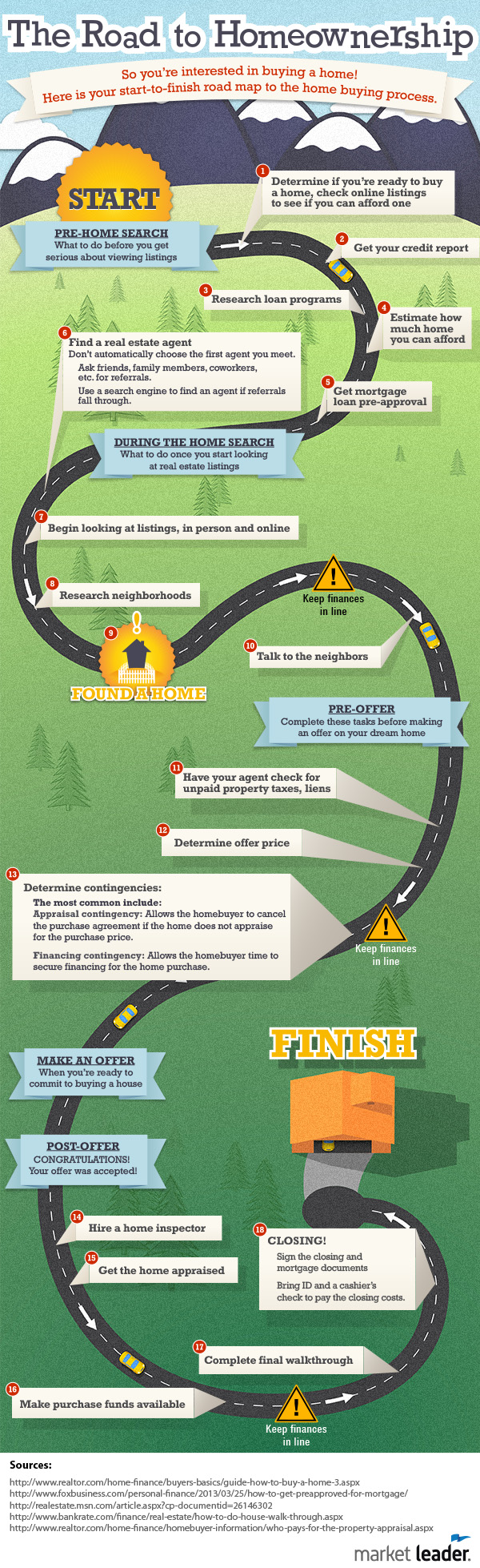

Time To Go Shopping

Once those preparations are out of the way, it is time to find the right property for you.

Take a Drive

Get to know the Lake Oswego neighborhoods and subdivisions, which interest you. Drive around get a feel for what it would be like to own a property in the area. Start getting a sense of the properties available in those areas.

Drive areas of interest at different times of day to see if there are any factors that will affect your enjoyment like traffic and schools.

Narrow Your Search

Select a few properties that interest you the most and contact us to make appointments to visit them. Ask your real estate agent about the potential long-term resale value of the properties you are considering.

Time to Make an Offer

Once you have picked out the property you want to purchase, we are here to help you make an offer that the seller will accept. A good Broker will investigate the potential costs and expenses associated with the new property. Our goal is to help you draft your offer in a way that gives you the advantage over another offer.

Inspections and Appraisals

Keep written records of everything. For the sake of clarity, it will be extremely useful to transcribe all verbal agreements including counter-offers and addendums and to convert them into written agreements to be signed by both parties. We will assist you in drafting all the paperwork for your purchase and make sure that you have copies of everything.

Stick to the schedule

Now that you have chosen your offer, you and the seller will be given a timeline to mark every stage in the process of closing the real estate contract. Meeting the requirements on time ensures a smoother flow of negotiations so that each party involved is not in breach of their agreements. During the process, we will keep you constantly updated, so you will always be prepared for the next step.

The Closing Agent

A title company will be selected as a closing agent. The closing agent is a neutral third party that will hold the deposit in escrow and will research the complete recorded history of the property to ensure that the title is free and clear of encumbrances by the date of closing and that all new encumbrances are properly added to the title. Some properties are subject to restrictions which limit various activities such as a building or parking restrictions. There may be recorded easements and encroachments, which limit the rights to use your property.

How to Hold Title?

You may wish to consult an attorney or tax advisor on the best way to hold the title. Different methods of holding title have different legal, estate and tax implications, especially when selling or upon the death of the title holder.

Inspections

Once your offer is accepted by the seller, you will need to have a licensed property inspector inspect the property within the time frame that was agreed upon in the effective contract to purchase. You may elect to have different inspectors inspect the property if you wish to obtain professional opinions from inspectors who specialize in a specific area (eg. roof, HVAC, structure). We can recommend several fantastic inspectors.

Depending on the outcome of these inspections, one of two things may happen:

1. Either each milestone is successfully closed and the contingencies will be removed, bringing you one step closer to the close, or

2. The buyer, after reviewing the property and the papers, requests a renegotiation of the terms of the contract (usually the price or repairs).

Appraisal and Lending

It is imperative that you keep in close communication with your lender, who will let you know when additional documents are needed to approve your loan application and fund your loan. If the agreement is conditional upon financing, then the property will be appraised by a licensed appraiser to determine the value for the lending institution, via a third party. This is done so that the lending institution can confirm their investment in your property is accurate. Appraisers are specialists in determining the value of properties, based on a combination of square footage measurements, building costs, recent sales of comparable properties, operating income, etc. When you are within two weeks of closing, double check with your lender to be sure the loan will go through smoothly and on time.

Property Insurance

If you are obtaining a loan, you will be required by your lender to purchase a certain amount of insurance on the property. The value will depend on the lending institution and the purchase price of the property. You may be able to save hundreds of dollars a year on homeowners insurance by shopping around for insurance. You can also save money with these tips.

We will be happy to recommend experienced knowledgeable insurance agents for every property type.

Closing Day

If you have come this far, then this means that it is almost time for congratulations, but not yet. Do not forget to tie up these loose ends.

Home Services and Utilities

We will provide a list of useful numbers for the activation of home services and utilities after the closing occurs.

Be Prepared

We are ready to assist you should an unforeseen glitch pop up, even at this last stage. Something at the property breaks down, or some other minor detail – no need to worry. We have encountered these problems before so we know how to handle them efficiently and in a stress-free manor.

Closing

The closing agent will furnish all parties involved with a settlement statement, which summarizes and details the financial transactions enacted in the process. You and the seller(s) will sign this statement, as well as the closing agent, certifying its accuracy. If you are obtaining financing, you will have to sign all pertinent documentation required by the lending institution. If you are unable to attend the scheduled closing, arrangements can be made depending on the circumstances and the notice that we receive. If you are bringing funds to the transaction, you can elect to either have the funds wired electronically into the closing agent’s escrow account, or bring a certified bank check to the closing in the amount specified on the settlement statement.